Limit orders

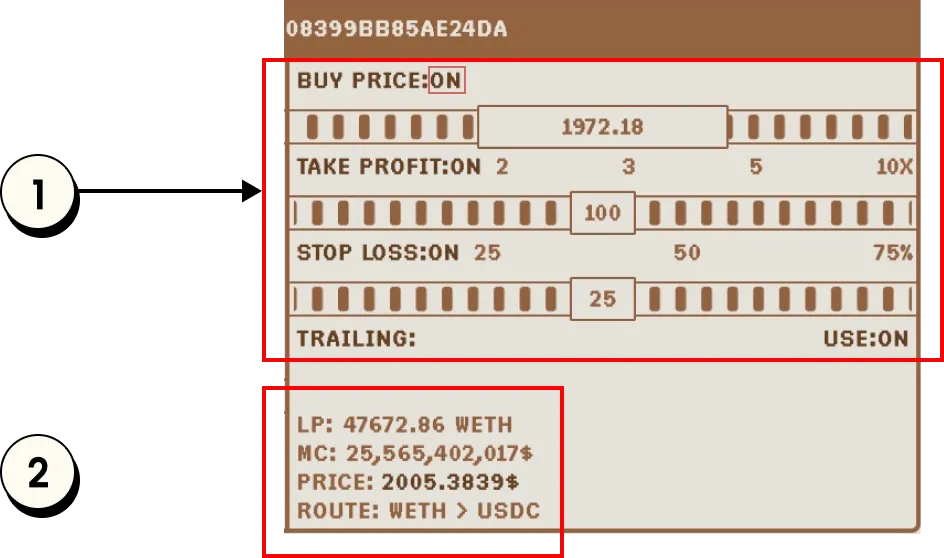

- Limit order settings:

- Buy price:

Enabled by click on "BUY PRICE:" button. When enabled - turns on buy limit order, which will buy setted amount when price will reach target. Contains buy price slider and input field for manual adjustment. - Stop loss:

Enabled by click on "STOP LOSS:" button. When enabled - turns on stop loss on the order. Contains stop loss slider and trailing stop switch. With trailing activated, your stop loss will adapt to new local all-time highs for your order. In simpler terms, a stop loss with an activated trailing stop transforms into a moving or trailing stop loss. You can read more about trailing in FAQ below this article. - Take profit:

Enabled by click on "TAKE PROFIT:" button. When enabled - turns on take profit on the order. Contains take profit slider and input field for manual adjustment.

- Buy price:

- Token information panel: Displays current liquidity, market cap, trade route and USD price for selected token. USD price is clickable button. On click it fills "BUY PRICE" input field for easier adjustment.

Tied limit order — a type of order where you turn off the buy price, but activate the take profit and/or stop loss options. During a transaction your order will be marked as regular market order, however, as soon as the purchase is completed, it will automatically transform into a sell limit order with the purchase outcome set at the acquired amount.

Limit orders list and history are located at "history" tab.

What "limit order" means and why it is a good thing to implement in trading strategy?

What "trailing" means in "stop loss" orders?